Chapter 2

Getting Started with Stock Trading

Before we jump into setting up accounts and placing trades, let’s start with a few stories — because every trader, no matter how experienced, had a "first trade."

Meet Kevin, a college student who stumbled upon a YouTube video about the stock market during finals week. Curious and a bit impulsive, he downloaded a brokerage app, deposited $100, and bought a single share of a trendy tech stock. He didn’t understand charts or financial statements — he just liked the company. Two weeks later, he had made $12. It wasn’t much, but to Kevin, it felt like magic. That small win lit the spark that led him to start learning seriously.

Then there’s Linda, a retired teacher. After watching her savings stagnate in a low-interest account for years, she decided to open a brokerage account. Unlike Kevin, Linda was cautious. She spent a month reading up on investing and only made her first trade after building a plan. Ten years later, her account had quietly grown alongside the market — not through flashy moves, but through patience and discipline.

And let’s not forget Dave, who went all-in on a stock he read about in an online forum. It soared 30% in a day — and then crashed 50% the next week. Dave didn’t lose everything, but the emotional rollercoaster taught him a lesson he’d never forget: stock trading can be rewarding, but only if approached with care, knowledge, and risk management.

These stories show that every trader starts somewhere — sometimes with luck, sometimes with mistakes, but always with that first step: getting started.

In this chapter, we’ll walk through the essential things you need to begin your trading journey. We’ll look at how to open a brokerage account, the mechanics of placing your first trade, important terms every trader should know, and the basics of managing risk. Whether you’re like Kevin, Linda, or Dave — or someone entirely different — this chapter will help you start on solid ground.

2.1 Setting up a brokerage account

Before you can start trading or investing in the stock market, you need a brokerage account. A brokerage is simply a platform that connects you to the stock market — it handles your trades, stores your money, and keeps track of your investments. Thankfully, opening an account today is easier than ever. With just a few taps on your phone, you can create and fund an account in minutes.

There are many popular brokerage platforms in the United States, and most of them offer similar core features. Here’s a quick overview of some of the most commonly used ones:

- Robinhood — Simple, user-friendly interface aimed at beginners. Commission-free trades, easy mobile app, and no account minimum. Lacks some advanced features but great for getting started.

- Fidelity — A well-established brokerage with excellent research tools, zero commissions, and strong customer service. Offers retirement accounts and a wide range of investment options.

- Charles Schwab — Another full-service brokerage with robust tools, commission-free trading, and a solid reputation. Suitable for both beginners and experienced investors.

- E*TRADE — A well-rounded platform with strong mobile and desktop experiences. Good for both casual investors and more serious traders.

- Webull — A newer app with more technical charts and analysis tools than Robinhood, also commission-free. Appeals to users who want more data without complexity.

For the purposes of this book, we’ll use Robinhood as our example platform. It’s easy to use, fast to set up, and has all the basic features needed to implement the strategies we’ll explore.

That said, because this book focuses on long-term investing — holding positions for a year or more — the choice of brokerage doesn’t matter that much. As long as you’re using a legitimate, regulated broker in the United States (all the ones listed above are), you can follow along just fine. You don’t need the fastest trade execution or the most advanced charting tools. What’s more important is building a solid strategy and sticking to it.

Requirements to Open a Robinhood Account

To open a Robinhood account, you need to meet the following criteria:

- Be at least 18 years old.

- Have a valid Social Security Number (SSN).

- Possess a legal U.S. residential address within the 50 states, Puerto Rico, or the U.S. Virgin Islands. Exceptions may apply for active U.S. military personnel stationed abroad.

- Be a U.S. citizen, U.S. permanent resident, or have a valid U.S. visa.

Additionally, you’ll need a compatible device. Robinhood supports:

- iOS devices running iOS 16 or newer.

- Android devices running Android 7 (Nougat) or later.

- Web browsers like Chrome, Safari, Firefox, and Edge on both Macs and PCs.

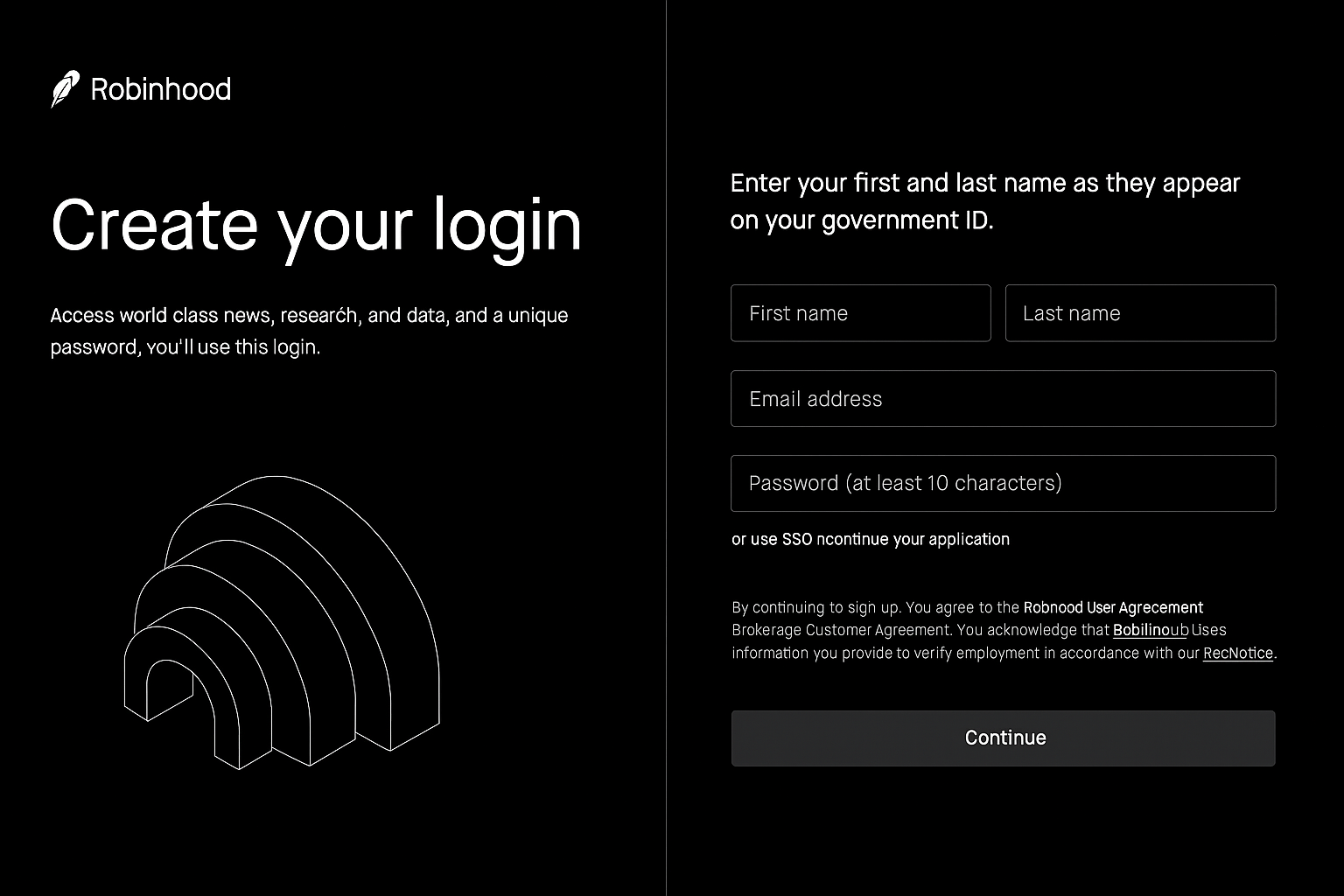

Steps to Open an Account

Opening an account with Robinhood is straightforward:

- Download the App or Visit the Website: Access Robinhood via its mobile app or website.

- Submit an Application: Provide your personal information, including your full name, date of birth, SSN, and residential address.

- Wait for Approval: Robinhood will review your application, which may take 5-7 days. They might request additional documents to verify your identity.

- Fund Your Account: Once approved, link your bank account to deposit funds. You can even queue a deposit during the application process; it will be processed upon approval.

Remember, while Robinhood is used as an example in this book, the principles and strategies discussed are applicable across various brokerage platforms. The key is to start with a platform that you’re comfortable with and that meets your investing needs.

A Note for International Investors

This book primarily focuses on U.S.-based brokerages like Robinhood, but that doesn’t mean investors from other countries can’t follow along or implement similar strategies. Many international investors can access U.S. stocks — including SPY — through global brokerage platforms or local financial institutions that offer overseas investment channels.

For example, in China, while it’s not possible to open a Robinhood account directly, some investors use platforms like Interactive Brokers. The specific options vary by country and are subject to local regulations.

If you’re outside the U.S., you’ll need to do a bit of research to find a brokerage that supports access to U.S. markets and aligns with your needs. Just make sure it’s a well-regulated and trustworthy platform. As long as you have access to trade SPY or similar ETFs, you’ll be able to apply the strategies discussed in this book.

2.2 How to place a trade

Once your brokerage account is set up and funded, you’re ready to place your first trade. This might sound intimidating at first, but the process is actually quite simple — especially if you’re using a beginner-friendly app like Robinhood.

Most brokerage platforms, including Robinhood, make placing a trade as easy as shopping online. Here are the basic steps you’ll typically follow:

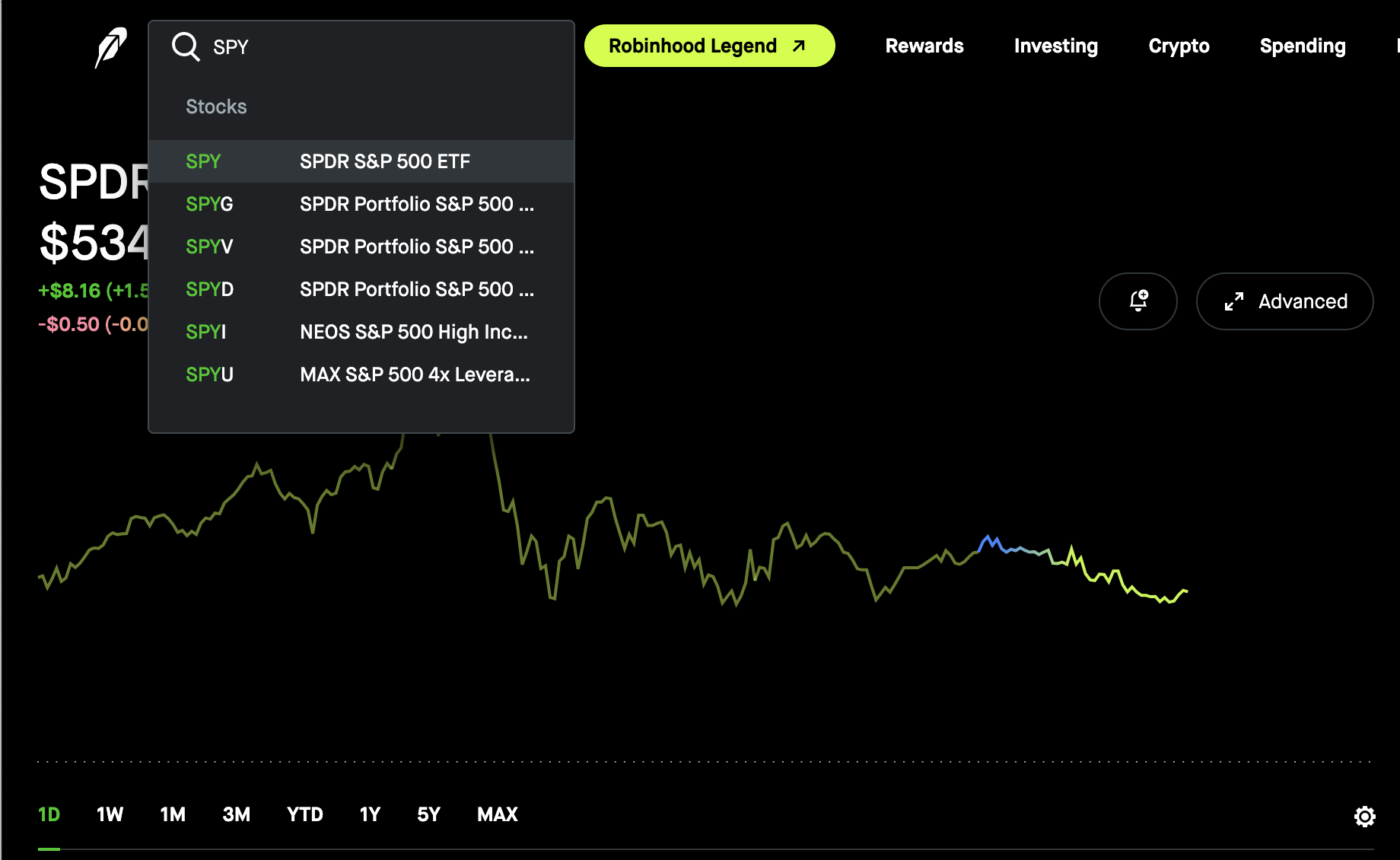

-

Search for a stock or ETF: Use the search bar to look up the symbol of the asset you want to trade. For example, if you want to invest in the S&P 500, you would search for SPY.

-

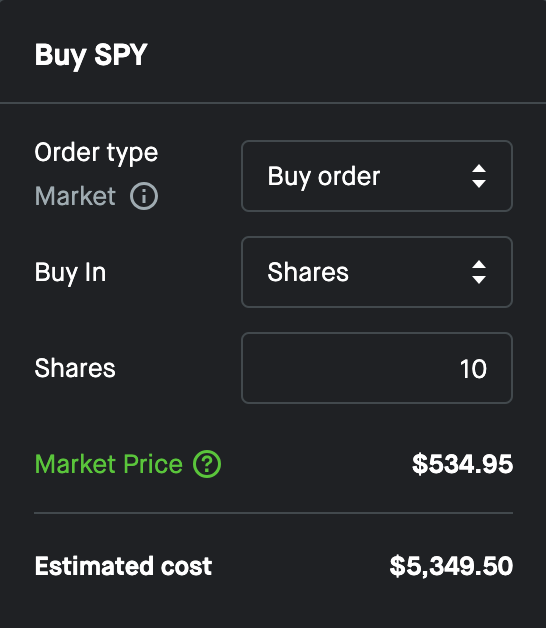

Once you’re on the asset’s page, you’ll see an option to buy.

-

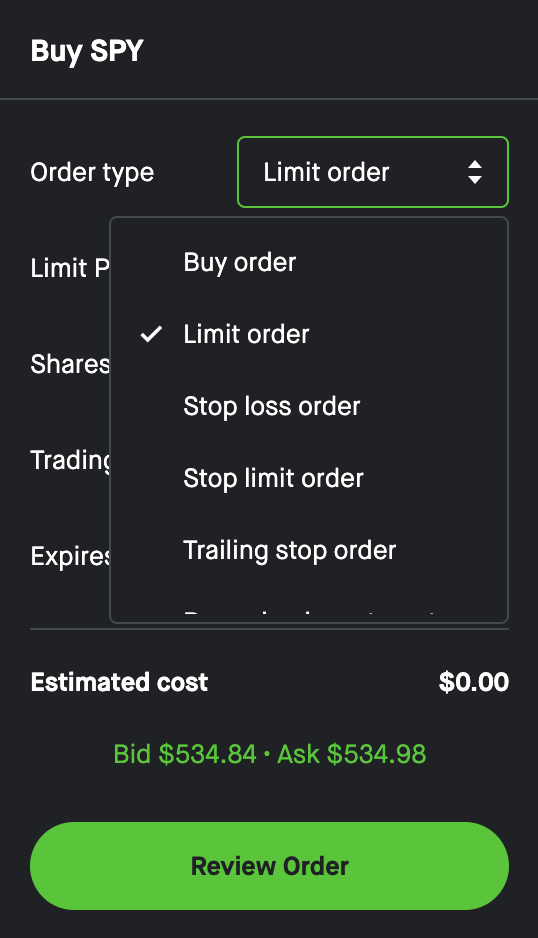

Choose the order type: Most platforms offer several types of orders. The most common are:

- Market order - Buys the stock immediately at the current market price.

- Limit order - Buys the stock only if it drops to a price you specify.

- Enter the amount: Decide how many shares you want to buy, or how much money you want to invest. On some platforms, you can buy fractional shares (for example, $50 worth of SPY instead of a full share).

- Review and confirm: Check the details of your order. If everything looks good, hit the "Submit" or "Buy" button.

And that’s it! You’ve placed your first trade.

A Few Tips

- Start small: If you’re new to trading, begin with a small amount so you can get comfortable with how the platform works.

- Don’t panic about price movement: Stocks and ETFs fluctuate all the time. As a long-term investor, short-term ups and downs are normal and not something to worry about.

- Use limit orders when needed: If you want more control over the price you pay, especially during volatile hours, limit orders are a great tool.

In the next sections, we’ll dive deeper into different types of orders and how to manage your risk — two key skills for becoming a confident and successful investor.

2.3 Key terminologies

Before placing trades regularly, it’s important to understand some common terms you’ll encounter on any brokerage platform. These concepts will help you trade more confidently and avoid costly mistakes.

Market order

A market order is the simplest way to buy or sell a stock. When you place a market order, you’re telling the broker to execute the trade immediately at the current best available price. This type of order guarantees that your order will be filled, but not the exact price.

When to use it: Market orders are best used when you want to buy or sell quickly and you’re okay with a small variation in price — for example, when trading highly liquid assets like SPY.

Limit order

A limit order allows you to set the maximum price you’re willing to pay when buying, or the minimum price you’re willing to accept when selling. The trade will only be executed if the market reaches your specified price.

When to use it: Limit orders are useful when you want more control over the price you pay or receive, and you’re willing to wait for the market to reach that level.

Stop loss order

A stop-loss order is designed to automatically sell your stock if the price drops below a level you specify. It helps limit your losses if the market moves against you.

Example: If you buy SPY at $400 and set a stop-loss at $380, your broker will try to sell it automatically if the price falls to $380 or lower.

Note: In highly volatile markets, a stop-loss order may execute at a lower price than expected.

Stop limit order

A stop-limit order combines features of a stop-loss and a limit order. It sets a trigger price to activate a limit order instead of a market order. This gives you more control over the minimum price you’ll accept.

Example: If SPY falls to $380 (stop price), your broker will place a limit order to sell it at $378 or better. If the market price skips past that, the order might not fill.

Trailing stop order

A trailing stop order is a type of stop-loss that automatically adjusts with the market price. Instead of setting a fixed stop price, you set a trailing amount — either a percentage or dollar amount — below (for sell orders) or above (for buy orders) the market price.

As the stock price moves in your favor, the stop price follows or "trails" it. If the stock price reverses by the trailing amount, the stop order is triggered and converts into a market order.

Example: Suppose you buy SPY at $400 and set a trailing stop of $10. If SPY rises to $430, your stop price will adjust to $420. If SPY then drops to $420, your shares will be sold to lock in profit. However, if SPY never rises and instead drops directly from $400 to $390, your shares will be sold at that point.

When to use it: Trailing stops are great for locking in profits while giving your trade room to grow. They’re especially helpful in volatile markets where you want to ride the trend but protect yourself if it turns sharply.

Bid, Ask, and Spread

- Bid — The highest price someone is willing to pay for a stock.

- Ask — The lowest price someone is willing to sell it for.

- Spread — The difference between the bid and ask prices. A smaller spread usually means the stock is more liquid.

Liquidity

Liquidity refers to how easily an asset can be bought or sold without affecting its price. Popular stocks like SPY have high liquidity, meaning you can enter or exit positions quickly with minimal price impact.

Volatility

Volatility measures how much a stock’s price fluctuates over time. High volatility means bigger price swings — which can offer more opportunity but also more risk.

Understanding these basic terms will help you read your trading screen more confidently and make smarter decisions. You don’t need to memorize everything at once — refer back to this section any time you need a quick refresher.

2.4 Risk management basics

Risk management is one of the most important skills any investor can develop. It’s what keeps a small mistake from becoming a disaster — and what allows you to stay in the game long enough to see long-term success. Even the best strategy won’t work if you don’t know how to protect your capital.

Never invest money you can’t afford to lose

This is rule number one. The stock market carries risk, and there are no guaranteed returns. Always invest with money you won’t need in the near future — not rent money, not emergency savings, and certainly not borrowed money.

Start small and scale up

When you’re just getting started, it’s a good idea to begin with small positions. This lets you learn how the market works and how your emotions respond to price movements — without putting too much at stake. As your confidence and understanding grow, you can gradually increase your position sizes.

Use stop-losses or exit rules

One way to manage risk is by setting a stop-loss — a predefined price at which you’ll sell to prevent further losses. For example, if you buy a stock at $100, you might decide to sell if it falls to $90. Even if you don’t use automatic stop-loss orders, you should still have a mental plan for when to cut your losses.

Don’t put all your money into one stock

Diversification is a basic risk management principle. Instead of investing everything into a single company, spreading your investments across multiple assets can reduce risk. The idea is simple: if one investment performs poorly, others may offset the loss.

However, SPY is a special case. It’s not a single company — it’s an exchange-traded fund (ETF) that tracks the S&P 500 index, which includes 500 of the largest publicly traded companies in the U.S. By holding SPY, you’re effectively owning a small piece of all those companies. In that sense, SPY is already highly diversified across sectors and industries.

That said, it still may be wise to consider additional diversification beyond just SPY — such as adding international exposure, bonds, or other asset classes depending on your financial goals and risk tolerance. But if you’re just starting out, investing in a broad index fund like SPY is often considered one of the safest and simplest ways to get diversified exposure to the stock market.

Understand position sizing

Position sizing is about deciding how much money to invest in a single trade. A good rule of thumb is to never risk more than 1-2% of your total account on a single position. This way, even if the trade fails, your overall portfolio can recover.

Avoid emotional decisions

Fear and greed are the two biggest enemies of successful investing. It’s easy to panic when a stock drops or get overly excited when it rises. Risk management helps you stick to your plan and avoid making decisions based on emotion.

Plan your exits — not just your entries

Many people focus only on when to buy a stock. But knowing when to sell is just as important. Will you sell if it drops 10%? Or if it rises 20%? Having a clear exit plan — whether for taking profits or cutting losses — helps you avoid impulsive mistakes.

Final thoughts

Risk management isn’t about avoiding risk entirely — that’s impossible in the market. It’s about making smart decisions that protect your capital and give you the best chance to grow it over time. The strategies in this book are designed with risk control in mind, but it’s up to you to apply them consistently and with discipline.

In future chapters, we’ll evaluate not just how to place trades, but how to decide when to enter and exit — using data, not guesswork. The strategies we’ll backtest on SPY are built from these building blocks.